CMO Digest

Megatrends Shaping Financial Services Marketing According to EY

The financial services industry is undergoing rapid transformation, driven by powerful forces reshaping how brands engage with clients, build trust, and deliver value. For CMOs, these "megatrends" provide both a roadmap and a challenge: how to lead decisively, align with evolving client expectations, and ensure lasting impact. This latest CMO Digest distils a recent report by EY into ‘Rethinking AI as Human Experience’ and a previous broader EY MegaTrends report into macro trends for financial marketers in banking, insurance, wealth management, and fintech to help them gain a competitive edge in an increasingly complex landscape.

Summaries of Key Trends

Behavioural Economy

Data-driven insights into consumer behaviours are transforming how businesses understand their customers. By leveraging advanced analytics, financial brands can anticipate client needs, create personalised experiences, and build long-term loyalty. With 70% of consumers increasingly choosing businesses that align with their personal values, financial institutions have the opportunity to shape customer engagement through transparency and empathy.

Work and Life Unbounded

The boundaries between work and personal life have become increasingly fluid, with flexible and hybrid working models now a permanent fixture in many businesses. With 60% of businesses planning to maintain hybrid models, the workforce is adapting to new demands for flexibility and innovation.

Future of Thinking

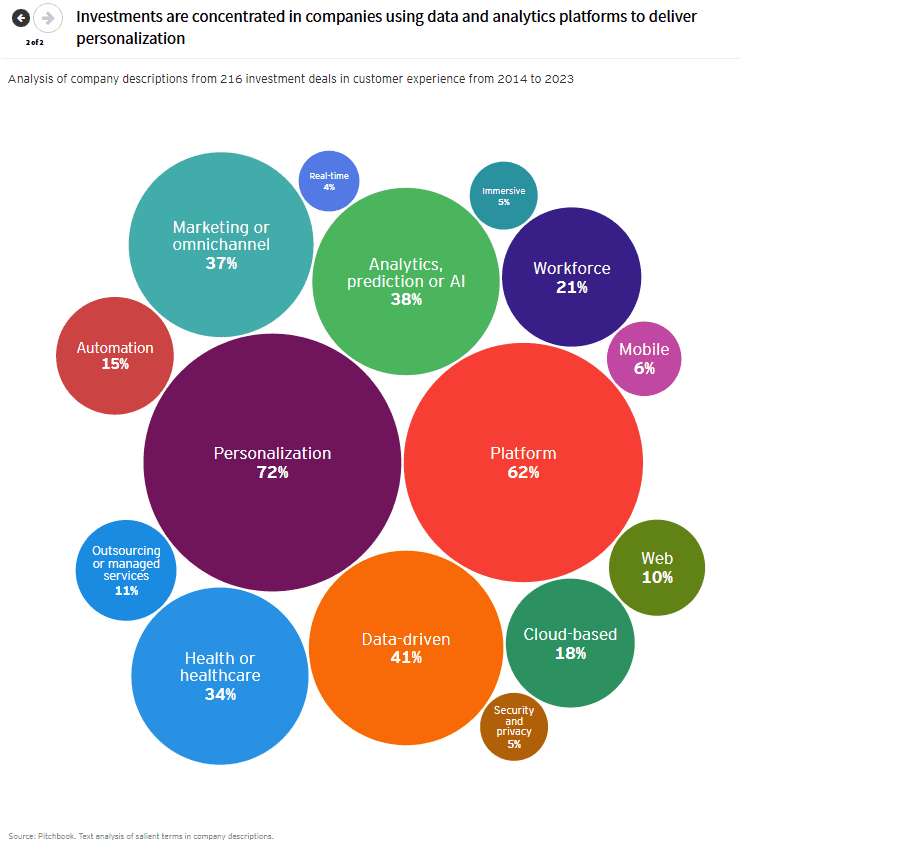

The rise of AI and cognitive technologies is enabling businesses to understand and respond to customer needs in real time. The integration of these technologies allows for more effective personalisation and the prediction of future client demands. In fact, 80% of CEOs across industries now view technology as the primary driver of business transformation. AI unlocks new ways to gain customer insight and deliver digital and physical customer experiences that could confer competitive advantage today, and in the near future, these customer experience tools will quickly become ubiquitous, setting a baseline of performance. A well-funded and rapidly growing universe of customer experience innovators will ensure that experience excellence is widely accessible. Over $100b in venture capital (VC) and private equity (PE) was invested in over 100 companies developing customer experience solutions between 2019 and 2023.

Opportunities – For Your Sector

Each financial sector has distinct opportunities to harness these megatrends and strengthen its competitive advantage:

Banking: Banks are well-positioned to integrate platform models, building more connected ecosystems that offer end-to-end services, from lending to wealth management. This integrated approach streamlines business processes and strengthens customer loyalty.

Insurance: By embracing behaviour-based pricing and customising coverage, insurers can turn risk management into an ongoing relationship with clients. Predictive analytics allow for smarter pricing and can ultimately reduce client churn by offering highly tailored policies.

Wealth Management: Wealth managers should look to integrate sustainability (ESG) into their investment strategies. As clients increasingly demand purpose-driven investments, integrating environmental, social, and governance (ESG) factors will not only attract clients but also demonstrate long-term vision.

FinTechs: Fintechs can lead the way by creating transparent, interconnected digital services. By embracing the behavioural economy, fintechs have the opportunity to build more personalised financial solutions, catering to a growing customer desire for transparency, simplicity, and speed.

Addressing the Gap – For Our Industry

While the megatrends offer substantial opportunities, there remain significant gaps in trust, talent, and adaptability. A key issue that many financial services brands still struggle with is the perception of trust, especially when it comes to how data is used. According to EY, 60% of consumers are concerned about how their personal data is handled, which makes transparency even more critical for financial institutions.

Additionally, while many financial firms are embracing digital transformation, there is still a lag in certain sectors when it comes to fully adopting AI and automation for personalisation.

Another challenge is talent. Despite the widespread move to hybrid work models, only 45% of financial services firms report that they are fully prepared to manage this shift, signalling an opportunity for CMOs to improve internal culture, digital capabilities, and client experience strategies.

Ensuring a flexible and digitally savvy workforce will be crucial for staying competitive in the future.

How to Accelerate

To capitalise on these megatrends and bridge the existing gaps, EY recommends several key strategies for financial services CMOs:

Integrate Platform Ecosystems: Financial institutions should consider expanding their services into a unified platform model, creating an interconnected system that enhances customer loyalty by offering more value through every interaction.

Build Resilience as a Core Brand Value: In a rapidly changing world, brands that highlight adaptability and resilience will stand out. Positioning these values at the heart of your brand’s message will resonate with customers seeking stability and innovation.

Prioritise Data Transparency: As trust is a major concern, especially regarding data privacy, CMOs must ensure transparency in their data practices. Clear communication about data usage will help to foster trust, with 60% of consumers now expecting businesses to be more transparent about how they handle personal information.

Foster Flexibility and Hybrid Workforce Models: With hybrid work models now a permanent fixture, CMOs should focus on building teams that are adaptable, diverse, and digitally skilled. A flexible approach to talent will not only improve internal operations but also demonstrate to clients that the brand is attuned to the demands of the modern workplace.

Lead on Sustainability: Financial services brands should integrate ESG initiatives into their business strategy to meet growing consumer expectations. With 60% of consumers saying they expect companies to address climate change, focusing on sustainability will build brand trust and loyalty.

Conclusion

The future of financial services marketing is being shaped by powerful megatrends. By embracing the opportunities presented by the behavioural economy, AI, and flexible working models, CMOs in financial services can position their brands for long-term success.

The best of both: Advice from EY

"Differentiated experiences will emerge from paradox: tech-driven seamlessness operating alongside the imperfections and frictions of human interactions."

With the right strategies in place, financial services brands can meet customer expectations, lead with transparency, and demonstrate resilience in a rapidly evolving marketplace. Now is the time for CMOs to act and ensure their brands not only survive but thrive in the new age of financial services.

Read the EY article: Rethink customer experience as human experience, July 2024

Read the EY MegaTrends report - 2020 and Beyond