CMO Digest

McKinsey's 9th Annual B2B Pulse Survey: How B2B winners keep growing

McKinsey's recent B2B Pulse Survey provides crucial insights into the current B2B sales and marketing landscape, unveiling five fundamental truths that CMOs in financial services must understand to formulate effective go-to-market strategies. The survey compiles perspectives from decision-makers across various sectors, highlighting emerging trends, customer expectations, and operational efficiencies.

Here’s our quick summary to guide strategic decision-making and resource allocation in a landscape increasingly dominated by digital interactions.

Opportunities for every sector – the Five Truths:

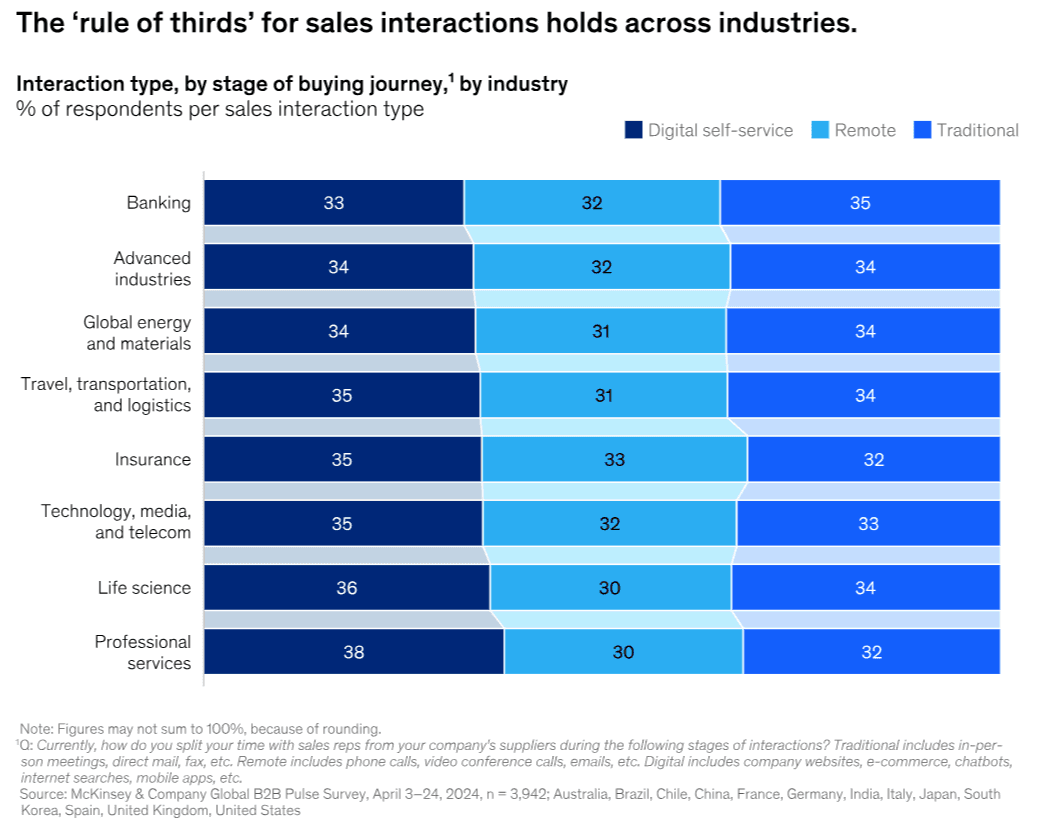

The Rule of Thirds: Customers are blending traditional and digital touchpoints. CMOs must reassess their engagement strategies to cater to diverse buyer preferences.

Seamless Omnichannel is Gold: With 54% of respondents likely to switch suppliers due to poor digital experiences, CMOs must prioritise integrating customer journeys across all channels and addressing pain points associated with numerous touchpoints.

E-commerce is Indispensable: E-commerce has become a leading revenue channel, accounting for 34% of sales. CMOs must advocate for digital investment to meet customer demands for seamless online transactions.

Hybrid Work Works: Companies embracing hybrid work environments have seen a 10% revenue increase. For CMOs, fostering flexible work arrangements enhances effectiveness, enabling Sales to meet customers in their preferred channels and locations.

Gen AI’s Got Game: With 19% of decision-makers now implementing generative AI, CMOs must leverage it to improve personalisation and operational efficiency, moving beyond traditional marketing tactics.

Opportunities for your sector

Retail Banking: CMOs can create personalised digital experiences, vital for understanding customer preferences in a multi-channel landscape.

Wealth Management: Wealth managers can harness data analytics to enhance client engagement, catering to the demand for tailored advice.

Insurance: Insurers need to expedite digital transformation to satisfy tech-savvy clientele, especially as many do not prioritise e-commerce.

Fintech: The sector should focus on secure, user-friendly experiences while capitalising on AI and digital channels.

Recognising Successes

Customers can now choose their preferred routes for their buying journeys, reflecting the evolution of B2B to align more closely with B2C expectations. This shift also indicates that marketers recognise the importance of allowing customers to dictate their own paths.

Addressing the Gap – for our industry

A significant finding is the expectation for seamless omnichannel experiences, with B2B buyers using an average of ten distinct channels. Notably, 39% are willing to spend over $500k online, up from 28% in 2022. Their willingness hinges on confidence in the digital experience.

This trend highlights the complexity of customer interactions, requiring CMOs to develop sophisticated strategies to manage multiple touchpoints effectively.

E-commerce examples for our FMI community may start with a website, but extend to the tools we have to capture a transaction or influence one: from onboarding experiences to trading platforms, compliance and reporting systems to personalised client portals. Each experience needs to be golden for the customer, capture data and deliver actionable insights for the CMO.

How to accelerate: Advice from McKinsey

Invest in Omnichannel Infrastructure: Ensure your technology supports seamless transitions across touchpoints to enhance customer journeys.

Enhance Customer-Centric Strategies: Focus on understanding and addressing customer pain points.

Integrate E-commerce Capabilities: Prioritise developing B2B e-commerce platforms to adapt to evolving purchasing behaviours.

Support Hybrid Work Models: Foster flexibility to engage with clients where and how they prefer.

Embrace AI for Personalisation: Deploy AI tools for tailored customer interactions.

Conclusion

CMOs must pivot their strategies to meet increasing expectations and address the complexities of the modern buying journey. Only by embracing these truths can financial institutions position themselves for sustained growth and success in a competitive landscape, learning from sectors that prioritised digital transformation and innovative sales channels.

This expectation now permeates the customer personas you aim to influence, whether they be CTOs, traders, or channel partners.