CMO Digest

Adobe 2024 Digital Trends report: Financial Services in Focus

Adobe’s latest report serves as a valuable guide, highlighting achievements, opportunities, and critical gaps within the financial services industry in AI implementation. We’ve summarised these findings for our network of CMOs to help direct effort and investment.

Recognising Successes

Positively, a significant 54% of FSI organisations are prioritising AI innovation to enhance customer experiences and improve operational efficiency. This commitment shows recognition of AI's potential to deliver personalised services at scale, essential for meeting evolving consumer needs.

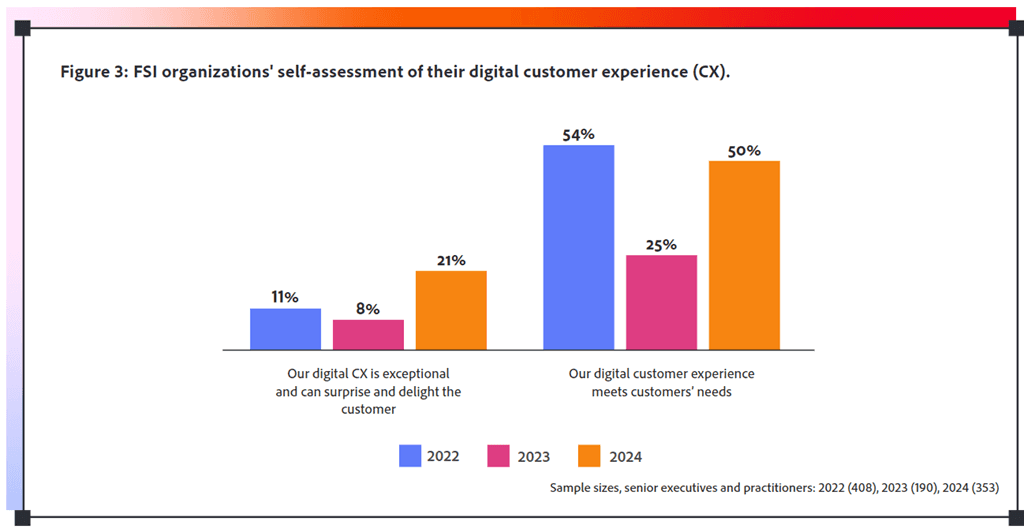

The report also reveals a shared understanding between FSI executives and consumers on the importance of personalisation and data-driven engagement. For example, 62% of executives see the need to unify data to improve customer interactions, aligning with consumer demands for personalised recommendations and seamless experiences across channels. This alignment presents a great opportunity for FSI organisations to strengthen customer relationships by focusing on what matters most. The report also shows encouraging signs that FSI organisations are making significant progress in digital CX, finding a record 21% rate their CX as “exceptional” in contrast to 8% in 2023 (see figure 3 from the report below).

Opportunities – For Your Sector:

Retail Banking:

CMOs in retail banking can leverage generative AI for personalised content delivery. This strategy not only enhances customer experience but also helps attract younger customers who prefer digital engagement. The report highlights that 71% of retail banks use data and analytics to predict customer needs, enhancing service offerings.Wealth Management:

CMOs in wealth management can utilise AI for customer insights and tailored investment recommendations. As early adopters of generative AI, these firms can create personalised experiences that resonate with affluent clients. The report notes that 44% are already using generative AI for personalised content, paving the way for deeper engagement.Insurance:

Insurance CMOs can accelerate digital transformation through AI to streamline product development and improve customer interactions. With 41% of insurers prioritising online sales and modernising experiences, they must use AI to enhance product recommendations and provide seamless digital services that meet complex customer needs. The report shows a growing recognition of the need for digital CX improvements in insurance.

Addressing the Gap – For Our Industry

Accelerate Generative AI Adoption: Only 25% of FSI organisations are ready to adopt generative AI, significantly trailing behind other industries. This lack of readiness reflects a broader caution, with many firms still in the early assessment and pilot project phases.

Align Executive and Consumer Expectations: The number one priority for consumers is trust and responsible data usage (88%). This ranks third for businesses. FSI organisations need to ensure they fully understand or address consumer needs, particularly regarding ethical data practices.

Focus on Skill Development: FSI firms are lagging in skill-building programs (21%) and aligning AI strategies with business goals (20%). This lack of preparedness may hinder effective AI implementation and innovation.

Unite Organisational Structures: Many organisations are still organised by business units and channels, complicating cross-functional collaboration crucial for AI implementation and customer experience enhancement. This fragmentation may lead to missed opportunities for seamless, personalised customer journeys.

Embrace Data Analytics: Despite recognising the importance of data to predict customer needs and its positive adoption, scope remains to effectively use data analytics for personalisation or recommendations.

Focus on Digital Experience: Although there is an improvement in digital CX ratings, only 21% of executives consider their CX exceptional. The report indicates ongoing challenges in achieving consistent, seamless interactions that meet evolving consumer expectations.

How to accelerate: Advice from Adobe

Establish the groundwork for enterprise AI adoption

Accelerate AI adoption by identifying use cases that impact consumers’ financial health

Start with context to deliver personalised financial guidance – then expand to use cases to improve digital CX across the board

Conclusion

Each sector must accelerate whilst addressing the confidence gap among consumers and focus on governance guidelines and standards. This ensures that when solutions are implemented, customers are ready and willing to embrace them. Ultimately, the real competitive advantage in AI implementation will go to firms that prioritise addressing customer concerns at the heart of their strategy.

In summary, adopting AI in the financial services sector is crucial for reducing costs, enhancing operational efficiency, and delivering superior customer experiences, if trusted.